Widespread adoption of mobile payments among enterprises and consumers alike will take time. But when you’ve got Apple, Google, Facebook, Samsung and (most likely) Microsoft jumping into the market, you’ve got traction.

Forrester研究预计到$ 142十亿美国移动支付将几乎从$ 52十亿(2014年)三(2019年)。

Gartner公司预计在今年及以后的移动支付,这将在2017年推动美国移动商务起到很大的作用,以全数字电子商务收入的50%,而22%为2015年年初“猖獗的利益”。

另据悉,由总结Statista,shows worldwide mobile payment volume growing from $325.2 billion in 2014 to $721.4 billion by 2017.

德勤预测,到今年年底,有近场通信(NFC),用户的5%-equipped智能手机将至少一个店内每月手机支付。虽然这是一个很小的比例,这是对谁做了NFC手机支付作为去年此时用户的0.5%,跳跃。

福利企业

Enterprises stand to benefit from mobile payments in multiple ways. As mobile payments gain wider consumer acceptance, retailers, restaurant chains and others have an opportunity to make paying for merchandise easier and, at least to some degree, more secure.

Plus, the growing use of mobile wallets can translate to greater use of mobile customer reward and loyalty cards. The data gleaned from those transactions can help enterprises more effectively and efficiently target promotions and learn more about customer preferences and habits.

顶级球员,现在和潜在的后来,在移动支付

苹果

在2014年秋季,苹果与支付在美国20万点的位置推出,达到700000个地点截至6月初,预计在本月创下超过100万个地点,根据苹果。苹果支付将在U.K亮相7月14日。

Also coming soon: With iOS 9 (due this fall), Apple’s Passbook app, which is where users store credit cards for mobile payments, will morph into Wallet. With Wallet, users will be able to add loyalty and rewards cards as well as merchant-specific credit cards. Apple has also announced a partnership with Square, which plans to release a new card reader designed to let small businesses accept Apple Pay.

最近,苹果公司申请了专利,以提供对等网络支付,有可能窃取来自PayPal和Square的牵引力。

(苹果付费)

(苹果付费)搜索引擎巨头已经开始摇晃了其移动支付平台,其失败的其2011年首次亮相后获得牵引力。谷歌支付将是支持所有的谷歌的支付服务,包括谷歌钱包的对等网络支付和Android Pay的平台,VentureBeat报告。Android Pay的是谷歌即将推出的竞争对手苹果支付。这将让消费者存储信用卡,借记卡和会员卡,在NFC搭载的终端使用和网上购物。

贝宝

贝宝has made several moves lately to bolster its mobile payments presence. In March, PayPal announced its acquisition of Paydiant, a startup platform that big retailers use to create branded mobile wallet apps. Paydiant enables consumers to make retail purchases via NFC or QR code.

贝宝is also releasing an NFC credit card reader. And on July 2, the company announced it had acquired Xoom Corp., considered among the top international payment companies, for $890 million.

Facebook的

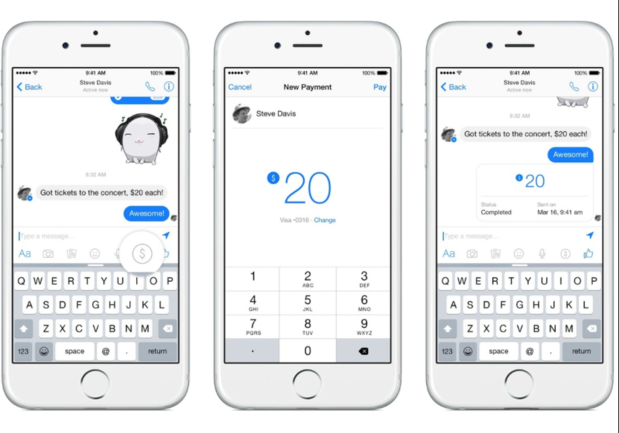

Facebook已经推出了支付功能来的使者,使FB的朋友通过应用程序和链接的借记卡互送的钱。Messenger的款项将与谷歌钱包,广场,潜在的苹果收费和Snapchat,使用方为对等网络支付平台竞争。

(透过Facebook Messenger)

三星

三星Pay, announced in March, is said to be set for a September launch in the U.S. and Korea. Along with NFC, Samsung Pay will use a technology called Magnetic Secure Transmission (MST) to beam credit-card info to card readers. With MST, Samsung Pay will reportedly work on 90 percent of existing payment terminals in the U.S.; Apple Pay and Android Pay can interact with NFC-only systems, which are still a minority.

Microsoft

There’s some uncertainty about what the folks in Redmond, Wash. are planning re: mobile payments. But it appears Microsoft “is looking to go up against Android Pay, Apple Pay and...Samsung Pay,” notes移动支付今天,在Windows 10的移动设备提供了一个“轻击以支付”功能。此外,微软可能会使用加密狗如那些来自PayPal和Square接受使用基于Windows的后端系统在任何平台付款。

Mobile Payment Challenges

尽管所有这些活动,在移动支付领域有一些跳铁圈通过它获得全球性的,主流的牵引力之前。它们包括:

*一个意识赤字。According to a December 2014 study byWakefield Research/Verifone,half of U.S. Internet users weren’t familiar with mobile payment technologies. The more mobile devices that support contactless payments, of course, the greater awareness will be.

* Security concerns.Fifty-six percent of consumers don’t want to store sensitive information, such as credit-card details, on their smartphones, according to a2015年2月哈里斯民意调查. But remember: consumers worried about security were slow to bank and buy during the Web’s early days.

* Competing technologies.Enterprises face a variety of mobile payment technologies to support, along with more traditional payment forms (such as credit and debit cards).

底线:对于任何成长的行业,一些移动支付球员将实现和保持牵引力,其他人将失去或从未得到它。消费者将变得不那么担心安全性和易用性和移动支付的利益所左右。

事实上,它已经发生了。研究公司eMarketer的says mobile wallets are “especially popular for smaller-ticket purchases” and cited a recent study showing that 84 percent of consumers are “open to using their smartphones to pay for small and medium purchases like a latte at Starbucks or a new set of sheets. It’ll take a little more time for consumers to feel comfortable purchasing larger ticket items -- for example, a luxury good or furniture -- with a smartphone. One thing at a time.”

Editor’s note:牵引观看is a new column focused obsessively on growth, and is a companion to theDEMO牵引会议系列,其中具有高潜力的客户带来高增长的创业公司一起。接下来的DEMO牵引将于9月16日在波士顿的地方,2015年成长型企业可以apply to present,or those similarly obsessed can在这里注册参加。

这个故事,“牵引观察:谁在移动支付产业获得牵引力”最初发表CIO .